The category of “specialist” seems to be ingrained deeply both in the history of evolution, and the development of modern society. Homo sapiens is, in its own ways, a specialist: We are most remarkable for our large brains and the application of our intelligence to achieve a remarkable adaptability. And the modern economy is unimaginable without the participation of a dizzyingly long list of experts, each managing a small but essential part of the complex machine that is the modern global economy.

But is specialization an innate behavior, or learned? Don’t we describe specialization negatively, with terms like “pigeon-holing?” Aren’t we in awe of the true jack-of-all-trades? To answer this question, there is perhaps no tool quite like economics. In its ability to measure and process large amounts of quantitative data, economics gives us a remarkably precise and evidence-based answer to the question of how we process information, and why we naturally tend to specialize.

We are all familiar with the saying “Don’t put all your eggs in one basket,” which applies to everything from job hunting to investing. In fact, it reflects the basic principle of modern portfolio theory: diversification. Strangely, however, investors roundly reject the principle of diversification when it comes to location, strongly preferring instead to invest locally (hence the phrase, home bias). While the existence of a home bias may at first seem to be a narrow behavioral quirk tied strictly to the world of investments, it provides a unique window into just how powerful a force specialization is.

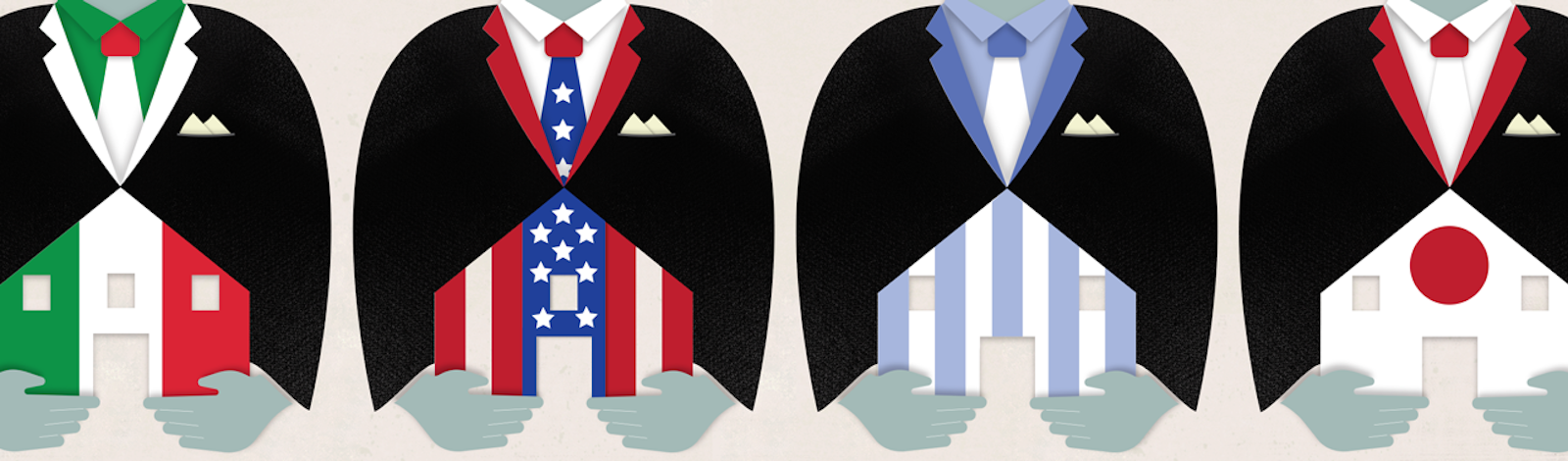

Harry M. Markowitz explained in his 1952 paper, “Portfolio Selection,” that investors should not focus solely on maximizing expected returns, but instead should find the right balance between risk and return. He formalized this objective using a simple mathematical function that took as inputs the mean, variance, and covariance of individual assets. His work earned him the 1990 Nobel Prize in Economic Sciences. But empirical evidence revealed a strong disregard for Markowitz’ teachings. In 1991, Kenneth R. French and James M. Poterba showed that American investors held nearly 94 percent of their equity portfolio in United States stocks, virtually ignoring the gains possible from international diversification. An even stronger investment bias was found in Japan, where investors held approximately 98 percent of their equity portfolio in Japanese stocks. Since these markets do not move perfectly in tandem, Americans would benefit from holding a larger share of Japanese stocks and vice versa.

American investors held nearly 94 percent of their equity portfolio in United States stocks.

Economists initially surmised that this “home bias” resulted from the cost of doing business abroad. After all, it is more expensive and more difficult for Americans to purchase Japanese stocks than domestic ones: Foreign stocks can involve higher brokerage fees, tax disadvantages, exchange rate hedging, and foreign regulation compliance. But this explanation turned out to be incomplete. Joshua D. Coval and Tobias J. Moskowitz published a 1999 paper showing that home bias existed even when national borders were not involved. Using 1995 holdings data on the largest U.S. money managers, the two authors computed the arc length distance (based on latitude and longitude coordinates) between each manager and every firm in which the manager actually invested or could have invested. Surprisingly, they found that home bias existed even at home! U.S. investment managers had a strong preference for investing in nearby companies over distant companies, even when both were in the U.S.

But there is minimal difference in the cost for a U.S. manager to invest in a firm headquartered in California, compared to one in New York. This means transaction costs were not the culprit. A second set of explanations rose to the fore: Perhaps investors were simply not rational. They could be overconfident of their knowledge regarding their local economy, leading them to underestimate local risks. Or they could simply be patriotic, investing locally in the same way people bet on home sports teams despite unfavorable odds.

Coval and Moskowitz shot this hypothesis down too. If home bias is explained by irrational behavior, it should lead to suboptimal portfolio allocations which, on average, do not perform well. But in a 2001 paper, the two researchers found that the opposite was true: Fund managers actually earned abnormally high returns from their local investments (defined as being within about 62 miles of fund headquarters), relative to their nonlocal investments.

So home bias is not a reaction to cost, nor is it irrational. The strongest remaining hypothesis is that home bias reflects something innate about how people react to holes and asymmetries in their knowledge about the world.

Perhaps investors were simply not rational.

Consider a Japanese investor who is interested in diversifying her investments into the United States. Suppose she is unfamiliar with the American economy, culture, and politics, and is concerned with the possibility of another U.S. government shutdown in 2014. Wouldn’t hiring a U.S. political consultant be a better strategy than simply abstaining from investing in U.S. stocks? Shouldn’t we expect her to study and learn about the political, cultural, and institutional aspects of the U.S., and hence level the playing field? Particularly for large investors, the rewards would appear to outweigh the costs.

But geographical patterns found in the volume of Internet search queries related to real-time financial information reveal that investors spend most of their time researching information relevant to local stocks. They choose to spend their resources amplifying their existing informational advantages, rather than eliminating informational disadvantages. Here, staring us in the face, and underpinning the home bias puzzle, is our basic tendency to drive towards specialization, rather than generalization—even when the potential exists for a generalist to benefit and potentially outcompete the specialist.

The underlying message is that our approach to knowledge is innately quite different from what we might naïvely expect. While we evaluate the worth of information with many different measures, one measure appears to be especially important: Whether that information revolves around us. This bias can be seen, as well, in the disparity between how we treat good news and bad news. While Americans tend to process good news better than bad news when it is local, the reverse is true when it is not local. This is consistent with psychological experiments showing that unfavorable information makes a greater impression on us than favorable information, when it is about someone else. When it is about ourselves, positive feedback is rationally processed (i.e., according to a Bayes’ rule), while negative feedback tends to be disregarded.

The recent solution to economic puzzles, like home bias, reinforce something we already intuitively understood: The specialist is here to stay.

Thomas Wu is Partner and Chief-Economist at Ventor Investimentos (a hedge fund based in Rio de Janeiro, Brazil) and Associate Professor of Economics at UC Santa Cruz. He has published a book, chapters in books, and academic journals on macroeconomics, international finance, and the Brazilian economy.