When Occupy Wall Street protesters began camping out in Zuccotti Park in 2011, Venkat Venkatasubramanian visited more than once. He didn’t participate in the protests against wealth inequality, he said, “but I knew what they were talking about. I knew that these were all legitimate concerns.”

The experience motivated Venkatasubramanian, today the Samuel Ruben-Peter G. Viele Professor of Engineering at Columbia University and director of the Complex Resilient Intelligent Systems Laboratory, to write How Much Inequality Is Fair? Mathematical Principles of a Moral, Optimal, and Stable Capitalist Society, published this year by Columbia University Press. The book is based on work parallel with his day job as a chemical engineer, over decades, treating inequality with his colleagues from an engineering systems, mathematical point of view. “This was more of a passion for evenings and weekends and summers,” he told me. “I didn’t mind this wild goose chase.”

The result is a surprising argument for the existence of an ideal inequality. Societies should be judged by how far away they are from perfect inequality, which has a definite mathematical form. “Ninety percent of people are not benefiting from the progress we’ve been making,” Venkatasubramanian explained in conversation. He believes he can help fix that by giving societies a clear wealth and income distribution target to aim for.

Nautilus caught up with Venkatasubramanian at his office on the campus of Columbia University.

How can we define a fair amount of wealth and income inequality?

When the effective utility that people earn is the same for everybody at all salary levels, from the janitor to the CEO, you achieve fair inequality. It comes from a particular mathematical distribution called a log-normal distribution. It is skewed to the left (lower incomes) with a long tail to the right (higher incomes). I take into account people’s contributions in a job—it is not about the actual paycheck. Let’s say John makes $100 an hour, and works for an hour. Now Jane works at the same job, also making $100 an hour, but she puts in two hours and makes twice as much. Is there income inequality? Yes. But is that inequality fair? Of course it is—Jane earned more because she contributed more. I generalize this notion for the entire economy, where there are people with different skills and different capacities for work, who will be rewarded differently for different contributions. In an ideal free market, their income will be equitable but not equal. That’s what I mean by fair inequality.

But isn’t inequality always bad?

Inequality per se is not bad. Some inequality is inevitable, even desirable, in a free-market society. As different people have different talents and skills, and different capacities for work, they make different contributions in a society, some more, others less. Therefore, it is only fair that those who contribute more earn more. But how much more? In other words, at the risk of sounding oxymoronic, what is the fairest inequality of income? This critical question is at the heart of the inequality debate. The debate is not so much about inequality per se as it is about fairness. Since maximizing fairness leads to an equitable outcome for all workers, my theory provides the moral justification for the free-market economy in mathematical terms.

How does entropy help us understand what is fair?

Consider a box with a partition in the middle, and lots of gas molecules in the left half and nothing on the other side. What is the probability of finding any molecule on the left side? 100 percent, because any molecule can exist only there. The right side is completely empty. If I remove this partition, the molecules will spread all over the box within a few milliseconds, equilibrium sets in, and entropy is maximized. Now any molecule is equally likely to be found on the left or right hand side. You’re making the fairest assignment between the left and right side of the box by maximizing entropy. So entropy really is a measure of fairness in the distribution. This critical insight about entropy as fairness has not been explicitly recognized and emphasized in prior work in statistical mechanics, information theory, or economics. In fact entropy is central to the functioning of an ideal free-market system.

Should economic theory be built around ideas like entropy?

Economics has often borrowed ideas from physics. Mainstream, or neoclassical, economics was largely inspired by classical mechanics. For example, economists use the terms “supply” and “demand” forces, and equilibrium is reached when these forces balance each other. But an economic system is a dynamical system with millions of players buying and selling goods and services. A more appropriate analog is statistical, not classical, mechanics. That’s why I call my theory “statistical teleodynamics”—just as the dynamics of molecules are driven by thermal agitation, leading to thermodynamics, the dynamics of rational entities, like us, are driven by their goals (telos is “goal” in Greek). My theory unifies the concept of entropy, from statistical mechanics and information theory, with potential, from game theory, and proves these represent the concept of fairness, from economics and political philosophy. This requires the economic profession to see statistical mechanics as the appropriate paradigm for at least certain classes of problems, such as income distribution, so we can make quantitative predictions and develop appropriate tax and transfer policies.

What does an ideal income distribution look like for a given country?

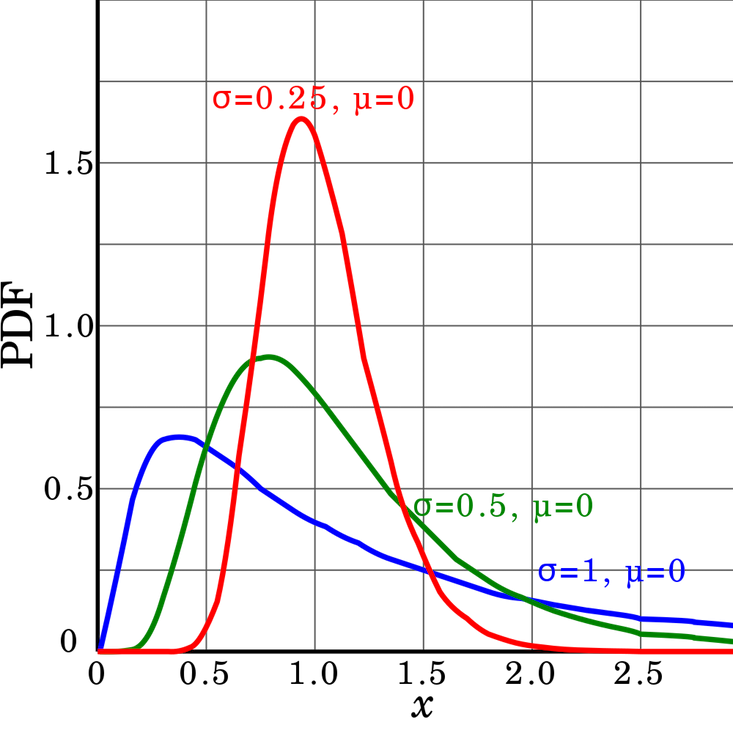

The ideal wage income distribution is log-normal. The shape of the log-normal distribution is completely determined by specifying its parameters, mu (μ) and sigma (σ). These depend on a country’s minimum income, maximum income, and average income. So, the first step is to calculate these parameters for the different countries—of course, they’re not the same. Here, for example, is what three lognormal distributions look like with the same mu, but different sigmas.

If you vary mu as well, the shapes can change even more. The exact shape determines the income shares of the bottom 90 percent, top 1-10 percent, and the top 1 percent. Even for the same country, they vary somewhat from year to year. So, as a result, different countries have different log-normals and hence different income shares. I obtain these by calculating the mu and sigma from the minimum, maximum, and average income of each country, convert income to ln(income), and then use normal distribution tables and to find the area under the normal curve (or the equivalent lognormal curve) which gives us income shares.

How should we measure inequality?

The theory proposes a new measure of inequality, called the non-ideal Inequality coefficient, or ψ. This coefficient measures deviations from ideal inequality. If ψ = 0, then that society has ideal, fairest inequality, which is the most desirable outcome. We, of course, don’t expect to see this for any real-life societies.

Which countries are most fair?

Norway and Sweden come very close to what is predicted by my theory. If Norway were to be a perfectly free-market society, as I define it, then 90 percent of the population should get 76.6 percent of the income. Norway comes very close to it. The data, from 2011, tells me that the bottom 90 percent are getting 71.7 percent. That gives them a non-ideal inequality coefficient of ψ = -6.5 percent. Denmark and Sweden are not far behind, at -8.6 percent and -9.1 percent. Now compare that with the United States: 70 percent of the income is what the bottom 90 should be getting, and they’re getting only 53 percent—way off. The non-ideal inequality coefficient for Canada is ψ = -20.2 percent, and Japan, ψ = -22.6 percent. The U.S. is ψ = -24.3 percent.

How can we move toward a more ideal income distribution?

A number of things. One is progressive taxation. You choose your tax rates in such a way that, after taxes and transfers, the income distribution is a lot closer to the ideal one. My work has defined the bull’s eye. Right now, we’re throwing darts not knowing where the target is. If the marginal tax rate were to go to 50 percent in the U.S., I don’t think it’s going to stop what drives the country, because we have existence proof. Look at the data from 1950s and 60s, when we had marginal tax rate of 90 percent. People still launched great companies.

What about corrections that don’t require redistributing wealth?

Yes, absolutely. Instead of doing this post-distribution, you can fix it in a pre-distribution way, which means the people at the bottom are paid better. That is the right way to do it, but it’s not easy. It’s a combination of several things that led to the current extreme inequality. It’s the unions being weakened, for one. The blue-collar workers by themselves have no negotiating power. A CEO has a lot of negotiating power. They don’t have to form a union—sitting at the top of the hierarchy, you have a lot of control. You pick the board, typically, to help you run the company, and who’s on the board? Typically, your friends and colleagues, who also help decide your salary. This is not a level playing field, not a free-market environment—it’s a country club environment. It’s all very secretive, done through head hunters, and so on—understandably, to some extent. That’s why there’s a lot more rent-seeking power. Globalization, automation, and deregulation also gave more power to the top. To compensate for that, you need to strengthen blue-collar workers and the middle class, tweak a lot of knobs. There’s no single magic bullet.

Is extreme inequality a serious problem?

Extreme inequality in the United States, and elsewhere, is deeply troubling on a number of fronts. First, there is the moral issue. For a country explicitly founded on the principles of liberty, equality, and the pursuit of happiness, protected by the “government of the people, by the people, for the people,” extreme inequality raises troubling questions of social justice that get at the very foundations of our society. We seem to have a “government of the 1 percent by the 1 percent for the 1 percent,” as the economics Nobel laureate Joseph Stiglitz wrote in his Vanity Fair essay. The Harvard philosopher Tim Scanlon argues that extreme inequality is bad for the following reasons: (1) economic inequality can give wealthier people an unacceptable degree of control over the lives of others; (2) economic inequality can undermine the fairness of political institutions; (3) economic inequality undermines the fairness of the economic system itself; and (4) workers, as participants in a scheme of cooperation that produces national income, have a claim to a fair share of what they have helped to produce.

You’re an engineer. How did you get interested in inequality?

I do design, control, optimization, and risk management for a living. I’m used to designing large systems, like chemical plants. I have a pretty good intuition for how systems will operate, how they can run efficiently, and how they may fail. When I started thinking about the free market and society as systems, I already had an intuitive grasp about their function. Clearly there are differences between a system of inanimate entities, like chemical plants, and human society. But they’re both systems, so there’s a lot of commonalities as well. My experience as a systems engineer helped me as I was groping in the darkness to get my hand around these issues, and to ask the right questions.

What do engineered systems, like chemical plants, have in common with human society?

First would be purpose. Nothing that’s engineered exists without a purpose. The model that’s there in the Declaration of Independence is amazing. We have agreed that the purpose of society is to facilitate the happiness of all citizens, not just the top 1 percent. Then comes a whole bunch of things we care about when designing a system, like robustness, stability, efficiency, and optimality. They’re engineered as a trade-off between efficiency and robustness, and this trade-off occurs in a human society. Morality will not be there typically—we don’t talk about the moral design of a chemical plant—but that becomes the central issue of human societies. We intuitively understand that when systems are grossly unfair, you have a revolution. Bastille Day happened because you can’t tell people, “Let them eat cake.” They’ll come back with pitchforks and torches.

Brian Gallagher is the blog editor at Nautilus.